GST Exemption for Flight Simulators to Boost Pilot Training in India

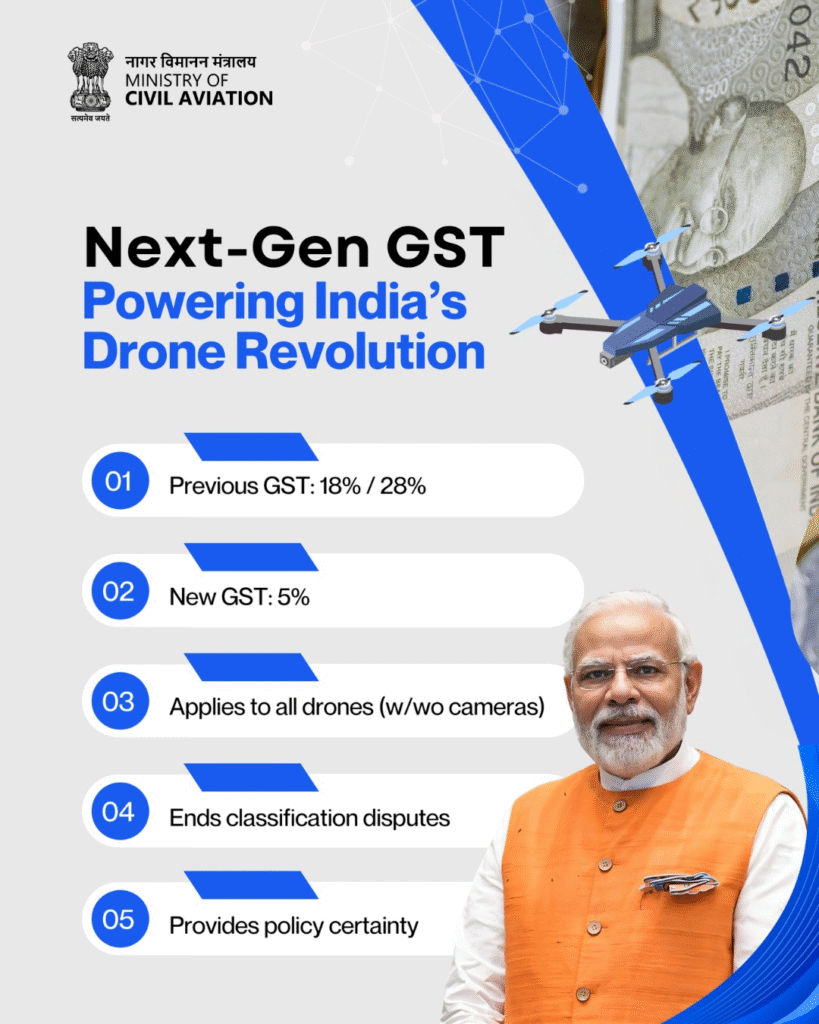

Recently, the government announced its Next Generation GST reform with a simplified two slab tax structure. With this an exemption on flight and motion simulators was also announced. The 5% GST on drones will reduce certainty and cost of equipment.

India being the third largest in the aviation industry after the US and China, so India’s aviation market is evolving and expanding. With this expanding market the demand for skilled pilots and advanced training infrastructure.

The government has taken a step that will make pilot training cheaper. Because of this cost reduction, more people will be able to join pilot training, which in turn will make India’s aviation industry stronger and ensure more trained professionals enter the system.

Key Aspects

- Training Cost Reduction: By reducing the cost of purchasing drone stimulators, by giving exemption in GST will ultimately make pilot training more affordable.

- Capacity Expansion: As more academies can now invest in simulators, there are more opportunities and increasing training slots for aspiring pilots.

- Uniform GST on Drones: A flat 5% GST rate for drones simplifies compliance and promotes wider adoption in industries like agriculture and logistics.

- Policy Alignment: These reforms support the government’s “Atmanirbhar Bharat” and “Make in India” initiatives by encouraging local aviation infrastructure.

- This will end classification disputes.

Image Source: MoCA_GOI

The GST exemption significantly reduces the financial strain on pilot training institutes. It also improves access for future aviators. Along with lower GST rates on drones, this policy shows India’s dedication to creating a competitive aviation training environment. As the demand for pilots increases, these changes will create opportunities for young people and boost India’s role as a major aviation center.